Table of Contents:

- Introduction

- Understanding Retirement Income Sources

- Investing for Retirement Income

- Real Estate Ventures in Retirement

- Passive Income Streams

- Freelancing and Consulting Opportunities

- Part-Time Employment in Retirement

- Monetizing Hobbies and Interests

- Social Security Optimization

- Creating a Retirement Income Plan

- Conclusion

Introduction:

Retirement marks a significant life transition where financial independence and security become paramount. However, retirement doesn't necessarily mean the end of earning potential. In fact, with strategic planning and smart investment decisions, individuals can continue making money in retirement, ensuring a fulfilling and financially stable post-career life.

Understanding Retirement Income Sources:

Explore the various sources of retirement income, including pensions, 401(k) or IRA withdrawals, annuities, and Social Security benefits. Discuss the importance of maximizing these income streams while considering tax implications and longevity.

Investing for Retirement Income:

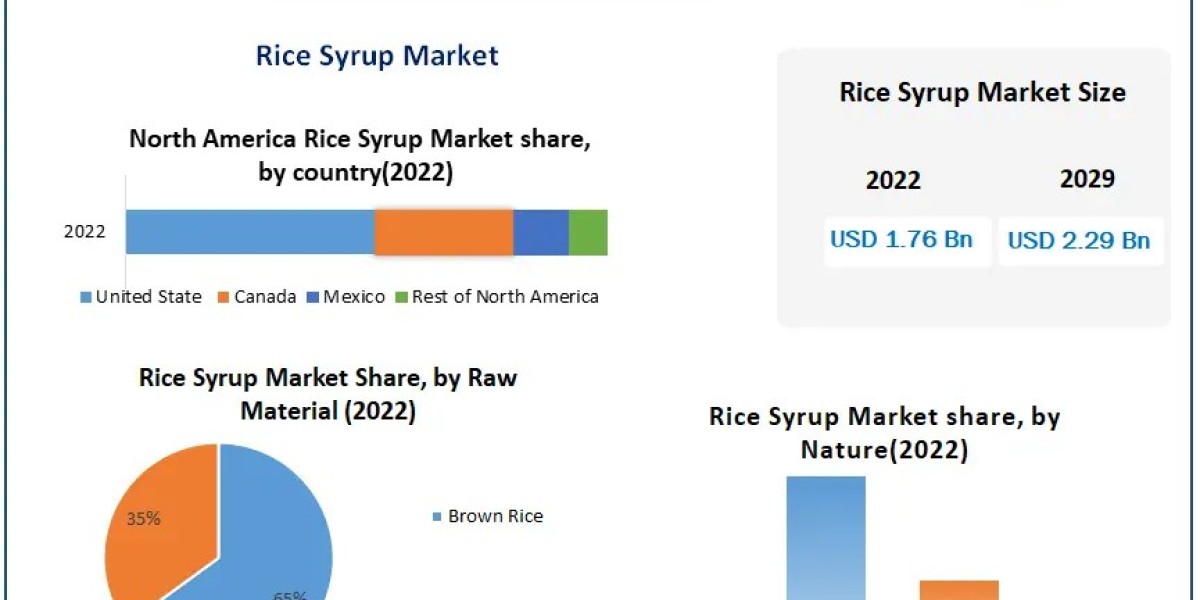

Dive into investment strategies tailored for generating retirement income, such as dividend-paying stocks, bonds, mutual funds, and real estate investment trusts (REITs). Emphasize the balance between income generation and portfolio growth to sustain long-term financial health.

Real Estate Ventures in Retirement:

Explore the potential of real estate investments in retirement, including rental properties, real estate crowdfunding, and property flipping. Discuss the advantages of real estate, such as passive income, tax benefits, and potential appreciation.

Passive Income Streams:

Introduce passive income streams like dividend stocks, peer-to-peer lending, royalties from intellectual property, and affiliate marketing. Highlight the benefits of passive income in providing ongoing revenue with minimal active involvement.

Freelancing and Consulting Opportunities:

Discuss the growing trend of freelancing and consulting among retirees, leveraging skills and expertise accumulated over a career. Explore platforms and networks that connect freelancers with clients and offer flexible work arrangements.

Part-Time Employment in Retirement:

Explore part-time job opportunities suited for retirees, such as retail positions, administrative roles, tutoring, or seasonal work. Discuss the balance between earning supplemental income and maintaining leisure time in retirement.

Monetizing Hobbies and Interests:

Encourage retirees to monetize their hobbies and passions, such as crafting, photography, writing, or teaching workshops. Explore avenues like online marketplaces, local markets, or teaching platforms to showcase and sell creations or skills.

Social Security Optimization:

Provide insights into optimizing Social Security benefits by understanding claiming strategies, spousal benefits, delayed retirement credits, and potential impacts on taxation. Empower retirees to make informed decisions to maximize lifetime benefits.

Creating a Retirement Income Plan:

Summarize key takeaways and guide readers in creating a personalized retirement income plan. Encourage diversification across income sources, prudent investment choices, regular reviews of financial goals, and adjustments as needed.

Conclusion:

Conclude by emphasizing that retirement doesn't signal the end of financial growth; rather, it opens doors to new opportunities for making money and ensuring a fulfilling and prosperous retirement journey. Encourage proactive financial planning, ongoing education, and a balanced approach to income generation and lifestyle enjoyment in retirement.

Recommended Article: How to Buy Bitcoin in 2024 | Easy steps