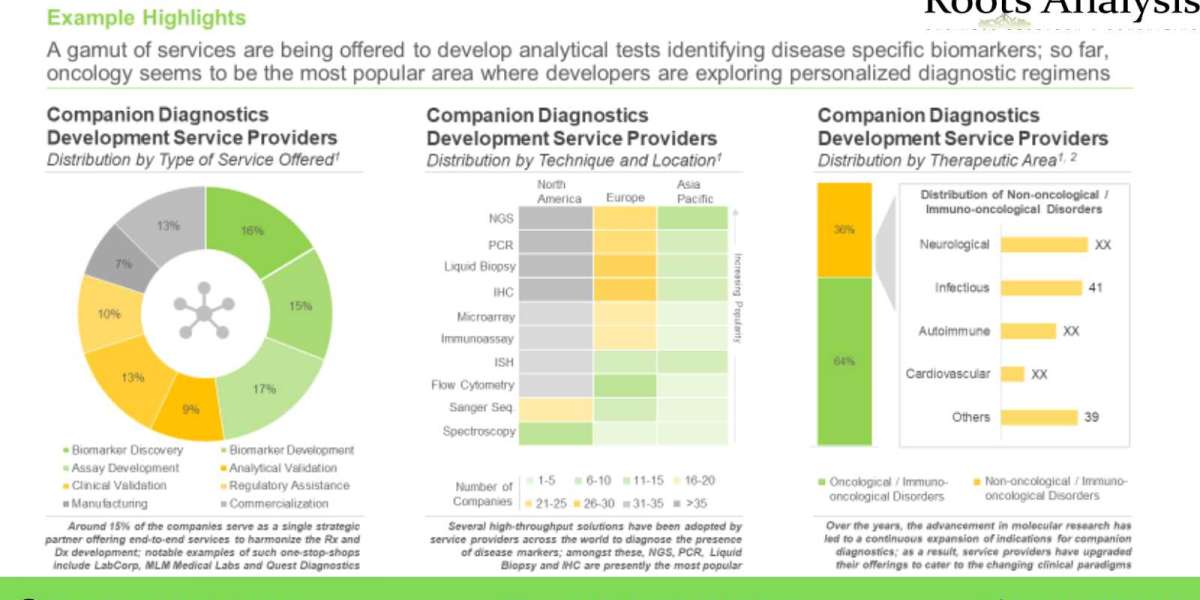

Given the various challenges associated with co-development of companion diagnostics and drug / therapy, drug developers prefer to rely on third-party service providers that offer customized services and advanced technologies.

Roots Analysis has announced the addition of “Companion Diagnostics Development Services Market (2nd Edition), 2022-2035” report to its list of offerings. The growing pipeline of patient-centric targeted therapies has led to a surge in demand for companion diagnostics; these tests are known to improve the success rates of late-stage trials by almost three-fold. The development and approval of these FDA classified high-risk devices requires multidisciplinary expertise and an established network of R&D and production facilities that can be accessed through service providers. Key Market Insights Over 150 companies claim to offer companion diagnostics development services, globallyNearly 60% of the aforementioned players are based in North America, followed by the players located in Europe (30%). Further, this segment of the industry is dominated by the presence of mid-sized players (51-200 employees), which represent 40% of the total service providers.Nearly 15% players claim to act as one-stop shops, offering services, ranging from biomarker discovery and development to manufacturing and commercializationMost of the service providers (127) provide assay development services, followed by companies (124) offering services for biomarker discovery / identification. Further, NGS is the most popular technique, employed by over 100 service providers.Over 90 companies are actively involved in the development of companion diagnosticsNearly 91% of the total tests can detect mutations in a single biomarker. Amongst these, ErbB gene family (HER-2 and EGFR genes), PD-L1 genes, RAS gene family (KRAS and NRAS genes), BRCA gene family (BRCA1 and BRCA2) and BRAF emerged as the key genes which are assessed by majority of the companion diagnostics.Partnership activity in this domain has increased at a CAGR of ~25%, between 2017 and 2021 Mergers and acquisitions, product development agreements and product development and commercialization agreements account for more than 60% of the total number of deals inked during the given time period. It is worth highlighting that nearly 25% of the total number of deals were signed in 2021. Further, the maximum number (177) of partnerships have been inked for companion diagnostics being developed for the treatment of oncological disorders.North America is expected to capture ~60% share in the companion diagnostics development services market by 2035Owing to the high costs associated with the clinical validation of companion diagnostics, a significant proportion (~46%) of service revenues is generated from this step, in 2035. In terms of analytical technique used, service contracts involving NGS are anticipated to contribute to more than 35% of the total service revenues generated in 2035. Further, close to 90% of the total service revenues, in 2035, are generated from companion diagnostics development projects for cancer indications.To request a sample copy / brochure of this report, please visit https://www.rootsanalysis.com/reports/297/request-sample.htmlOne of the key objectives of the report was to estimate the existing companion diagnostics market size and the potential future growth opportunities for companion diagnostics development service providers. Based on multiple parameters, such as the service cost of various steps involved in companion diagnostics development and manufacturing, and partnerships inked in the last few years for outsourcing of such operations, we have developed informed estimates on the evolution of the market for the time period 2022- 2035. An insightful analysis of companies segregated on the basis of their likelihood to enter into collaborations with companion diagnostics service providers. The chapter features a list of 300+ drug developers sponsoring clinical trials of therapies targeting several disease-specific biomarkers. The players have been shortlisted based on relevant parameters, namely number of biomarker-focused clinical trials sponsored and the time to market their proprietary personalized medicine products.Key Questions Answered Who are the leading players offering services for the development of companion diagnostics? Which are the key geographies where companion diagnostics development service providers are located? Which analytical techniques are used by the service providers engaged companion diagnostics development services market? Who are the leading companion diagnostics developers? Which biomarkers are most commonly targeted by the marketed products / investigational programs? Which partnership models are commonly adopted by stakeholders offering companion diagnostics development services? Which drug developers are most likely to partner with the service providers to seek their expertise? What are the key value drivers of the merger and acquisition activity within companion diagnostics development services market? Which biomarker-focused targeted drugs developed by big pharmaceutical companies are likely to be administered with companion diagnostics? How is the current and future opportunity likely to be distributed across key market segments?The financial opportunity within the companion diagnostics development services market has been analyzed across the following segments: Type of Service Offeredo Feasibility Studieso Assay Developmento Analytical Validationo Clinical Validationo Manufacturing Type of Technique Usedo NGSo PCRo ICH / ISHo Liquid Biopsyo Others Therapeutic Areaso Oncologicalo Non-oncological Key Geographical Regions o North America o Europeo Asia-Pacific and Rest of the WorldThe report also features detailed transcripts of discussions (in reverse chronological order) held with the following experts: Mike Klein (Chief Executive Officer, Genomenon) Mark Kiel (Founder and Chief Scientific Officer, Genomenon) Candace Chapman (Vice President of Marketing, Genomenon) Anton Iliuk (President and Chief Technology Officer, Tymora Analytical Operations) Paul Kortschak (Former Senior Vice President, Novodiax) Pablo Ortiz (Chief Executive officer, OWL Metabolomics) Lawrence Weiss (Former Chief Scientific Officer, NeoGenomics Laboratories)The research includes detailed profiles of key players (listed below), each profile features an overview of the company, its financial information (if available), drug portfolio, details on recent developments, and an informed future outlook. Almac Diagnostic Services BGI Genomics Biocartis Cerba Research Geneuity Clinical Research Services Interpace Biosciences Labcorp (formerly known as Covance) MEDICAL & BIOLOGICAL LABORATORIES (MBL) MEDx (Suzhou) Translational Medicine (formerly known as QIAGEN (Suzhou) Translational Medicine) MLM Medical Labs Novogene Q2 Solutions Quest Diagnostics ResearchDxFor additional details, please visit https://www.rootsanalysis.com/reports/view_document/companion-diagnostics-services/297.html or email sales@rootsanalysis.com You may also be interested in the following titles: 1. Targeted protein degradation market, 2022-20352. Cell Therapy Manufacturing Market, 2022-2035 About Roots AnalysisRoots Analysis is one of the fastest growing market research companies, sharing fresh and independent perspectives in the bio-pharmaceutical industry. The in-depth research, analysis and insights are driven by an experienced leadership team which has gained many years of significant experience in this sector. Contact:Ben Johnson+1 (415) 800 3415+44 (122) 391 1091Ben.johnson@rootsanalysis.com

Caramelized Australian Balsamic: Elevate Your Culinary Experience with Aussie Basket's Finest

Caramelized Australian Balsamic: Elevate Your Culinary Experience with Aussie Basket's Finest

Unveiling the Surprising Benefits of Affordable Hair Transplants in Turkey

Unveiling the Surprising Benefits of Affordable Hair Transplants in Turkey

The Thrilling World of Aviator Game: A New Era in Online Gaming

By annamdkkd

The Thrilling World of Aviator Game: A New Era in Online Gaming

By annamdkkd VIP Travel Experience: Elevating Your Journey with Luxury Airport Transfer Services

VIP Travel Experience: Elevating Your Journey with Luxury Airport Transfer Services

VIP Travel Experience: Elevating Your Journey with Luxury Airport Transfer Services

VIP Travel Experience: Elevating Your Journey with Luxury Airport Transfer Services