In the realm of industrial metals, copper stands as a bellwether for economic activity worldwide. Its applications span construction, electronics, transportation, and renewable energy, making it indispensable to modern infrastructure and technology. As we delve into the current landscape and project the future trajectory of copper prices, several key factors come into play. This forecast report aims to provide a comprehensive analysis, offering insights into market dynamics, supply-demand dynamics, and a detailed forecast for the coming years.

Request a free sample copy in PDF: https://www.expertmarketresearch.com/price-forecast/copper-price-forecast/requestsample

Forecast Report

Copper prices have exhibited volatility in recent years, influenced by global economic conditions, geopolitical factors, and shifts in supply and demand. The ongoing recovery from the COVID-19 pandemic has significantly impacted commodity markets, including copper. Looking ahead, the forecast suggests a cautiously optimistic outlook with potential for growth tempered by supply chain challenges and macroeconomic uncertainties.

Outlook

The outlook for copper price hinges on multiple variables:

- Global Economic Recovery: As economies rebound from the pandemic-induced slowdowns, industrial activity and infrastructure investments are expected to drive demand for copper.

- Infrastructure Investments: Governments worldwide are prioritizing infrastructure development, particularly in renewable energy and electric vehicles (EVs), which are copper-intensive sectors.

- Supply Chain Constraints: Challenges in supply chains, including transportation and logistics bottlenecks, may constrain the availability of refined copper, affecting prices.

- Geopolitical Factors: Geopolitical tensions and trade policies can disrupt supply chains and influence investor sentiment, impacting price trends.

Market Dynamics

The dynamics influencing copper prices are multifaceted:

- Demand Growth: Growing electrification trends, driven by EV adoption and renewable energy projects, are expected to boost copper demand significantly.

- Supply Challenges: Mining disruptions, declining ore grades, and operational challenges at major mines contribute to supply-side risks, potentially tightening market conditions.

- Investor Sentiment: Speculative trading, influenced by macroeconomic indicators and geopolitical developments, can lead to short-term price fluctuations.

Read Full Report With Table Of Contents: https://www.expertmarketresearch.com/price-forecast/copper-price-forecast

Demand-Supply Analysis

Demand Drivers:

- Electric Vehicles (EVs): The shift towards cleaner transportation fuels demand for copper in EV batteries, charging infrastructure, and motors.

- Renewable Energy: Solar and wind energy systems rely on copper for transmission lines, inverters, and transformers, amplifying demand.

- Construction and Infrastructure: Urbanization and infrastructure projects in emerging markets continue to drive copper consumption in building materials and electrical wiring.

Supply Challenges:

- Mine Production: Aging mines and declining ore grades pose challenges to maintaining current production levels.

- Operational Disruptions: Labor strikes, regulatory changes, and environmental concerns can disrupt mining operations, impacting supply.

Extensive Forecast

Based on current trends and future projections, the following forecasts are envisioned:

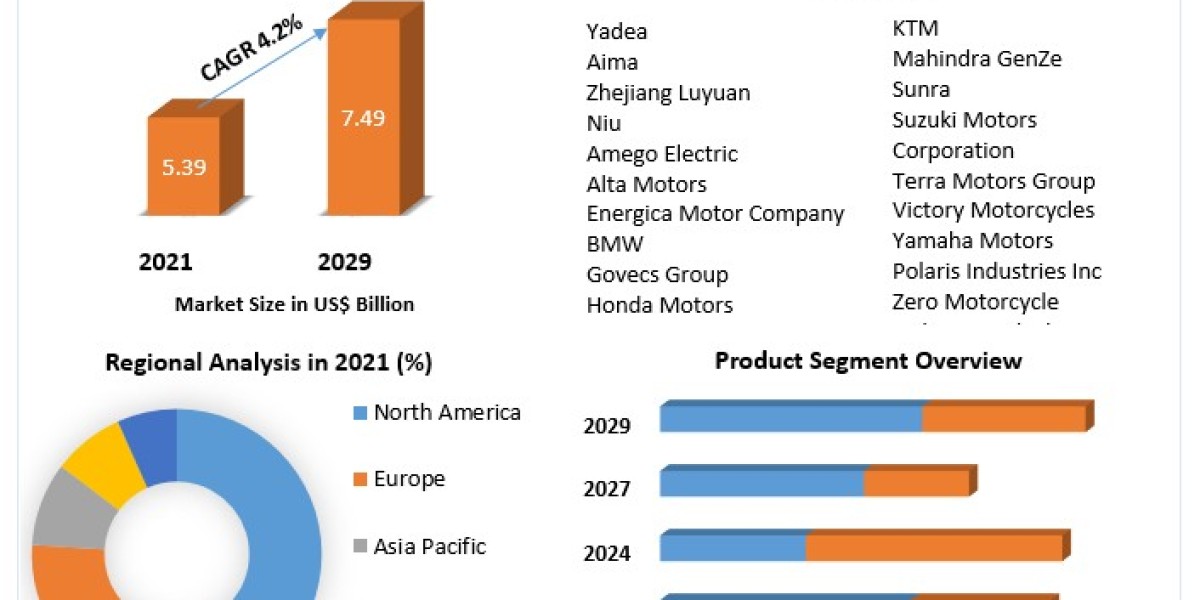

- Short-term: Prices may experience volatility amidst economic recovery and supply chain challenges, ranging between $4.00 to $4.50 per pound.

- Medium-term: With increased infrastructure spending and technological advancements, prices could stabilize and trend upwards towards $5.00 per pound by 2025.

- Long-term: Beyond 2025, sustained demand from renewable energy and electrification projects may push prices upwards of $6.00 per pound, contingent on supply-side developments.

Detailed Insights

Navigating the complexities of the copper market requires a nuanced understanding of:

- Technological Innovations: Advancements in extraction techniques and recycling technologies can mitigate supply constraints and influence pricing dynamics.

- Regulatory Landscape: Environmental regulations and policies aimed at sustainable mining practices could reshape industry dynamics and production costs.

- Global Trade Dynamics: Tariffs, export restrictions, and trade agreements play pivotal roles in shaping international copper flows and pricing mechanisms.

In conclusion, while copper prices are poised for growth driven by expanding industrial applications and green initiatives, inherent risks such as supply disruptions and economic uncertainties necessitate vigilance. Stakeholders across industries must stay attuned to evolving market dynamics and leverage strategic insights to navigate the intricate landscape of the copper market effectively.

Media Contact:

Company Name: Claight Corporation

Contact Person: Christeen Johnson

Email: sales@expertmarketresearch.com

Toll Free Number: US +1–415–325–5166 | UK +44–702–402–5790

Address: 30 North Gould Street, Sheridan, WY 82801, USA