The global SiC MOSFETs market was valued at US$ 435.7 million in 2022 and is projected to reach US$ 1251.4 million by 2029, at a CAGR of 16.3% during the forecast period. The influence of COVID-19 and the Russia-Ukraine War were considered while estimating market sizes.

| Market size in 2022 | US$ 435.7 million | Forecast Market size by 2029 | US$ 1251.4 million |

|---|---|---|---|

| Growth Rate | CAGR of 16.3% | Number of Pages | 200+ Pages |

Silicon carbide MOSFETs have the characteristics of low on-resistance and small switching losses, which can reduce device losses and improve system efficiency, and are more suitable for high-frequency circuits. It is widely used in the fields of new energy vehicle motor controller, vehicle power supply, solar inverter, charging pile, UPS, PFC power supply and other fields.

SiC MOSFETs refers to Silicon Carbide Metal-Oxide-Semiconductor Field-Effect Transistors. These are power semiconductor devices that use silicon carbide as the semiconductor material for their channel, offering advantages over traditional silicon-based devices in certain applications.

![]()

SiC MOSFETs Market aims to provide a comprehensive presentation of the global market for SiC MOSFETs, with both quantitative and qualitative analysis, to help readers develop business/growth strategies, assess the market competitive situation, analyze their position in the current marketplace, and make informed business decisions regarding SiC MOSFETs. SiC MOSFETs Market contains market size and forecasts of SiC MOSFETs in global, including the following market information:

Global SiC MOSFETs Market Revenue, 2018-2023, 2024-2029, ($ millions)

Global SiC MOSFETs Market Sales, 2018-2023, 2024-2029, (K Units)

Global top five SiC MOSFETs companies in 2022 (%)

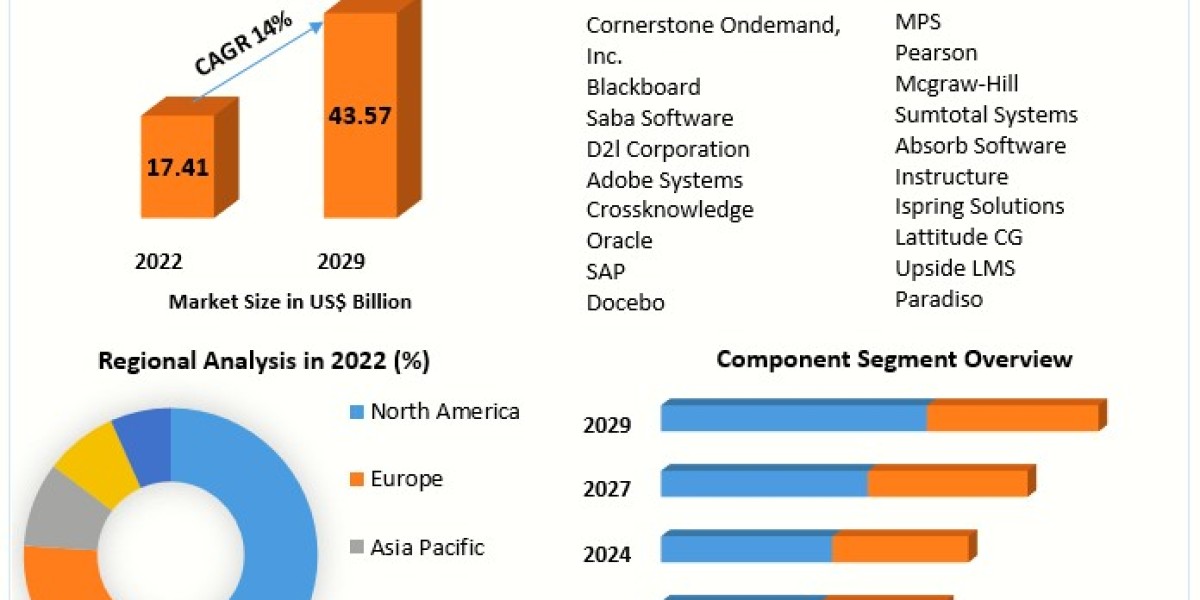

Market Valuation and Growth Projection

- The global SiC MOSFETs market, valued at US$ 435.7 million in 2022, is anticipated to experience robust growth, reaching US$ 1251.4 million by 2029.

- The projected Compound Annual Growth Rate (CAGR) stands at an impressive 16.3% during the forecast period.

- Factors such as the influence of COVID-19 and the ongoing Russia-Ukraine War have been meticulously considered in estimating market sizes, ensuring a comprehensive outlook.

Key Players in the SiC MOSFETs Market

- Wolfspeed: A major player in the SiC MOSFETs market, contributing significantly to technological advancements and market growth.

- Infineon Technologies: Renowned for its innovative solutions, Infineon Technologies plays a pivotal role in shaping the SiC MOSFET landscape.

- STMicroelectronics: A key player known for its expertise in semiconductor technologies, making substantial contributions to the SiC MOSFET market.

- ROHM: Acknowledged for its cutting-edge semiconductor products, ROHM holds a prominent position among global SiC MOSFET manufacturers.

Market Concentration among Top Manufacturers

- The top three manufacturers collectively dominate the market, accounting for a substantial 52% share.

- This concentration highlights the competitive landscape and the strategic significance of these key players in steering the industry’s direction.

Regional Analysis of the SiC MOSFETs Market

Europe: Largest Market Share

- Europe emerges as the largest market for SiC MOSFETs, commanding a significant share of over 74%.

- The region’s dominance is indicative of its strong presence in the semiconductor industry and commitment to adopting advanced technologies.

Asia-Pacific (APAC) and North America

- Asia-Pacific (APAC): Following Europe, APAC secures the second-largest market share at 18%, reflecting the region’s growing demand for SiC MOSFETs and its role as a key manufacturing hub.

- North America: With a share of 6%, North America contributes to the global market, showcasing the region’s technological adoption and market participation.

Key Factors Driving Market Growth

- Technological Advancements: Ongoing innovations in SiC MOSFET technology contribute significantly to market expansion.

- Rising Demand in Power Electronics: The increasing adoption of SiC MOSFETs in power electronics applications fuels market growth.

- Global Events Impact: Consideration of the impact of events like the COVID-19 pandemic and the Russia-Ukraine War underscores the market’s resilience and adaptability.

Future Outlook and Challenges

- The SiC MOSFETs market is poised for continuous growth, driven by advancements in semiconductor technology and expanding applications in various industries.

- However, challenges such as supply chain disruptions and geopolitical tensions may pose potential hurdles, necessitating strategic planning for sustained growth.

We surveyed the SiC MOSFETs manufacturers, suppliers, distributors and industry experts on this industry, involving the sales, revenue, demand, price change, product type, recent development and plan, industry trends, drivers, challenges, obstacles, and potential risks.

Total Market by Segment:

- 1200 V Type

- 1700 V Type

- 650 V Type

- Other

- PV Inverter and Converter

- Smart Grid

- Hybrid Electric Vehicle (HEV)

- Other

- North America (United States, Canada, Mexico)

- Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe)

- Asia-Pacific (China, India, Japan, South Korea, Australia, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

- Key companies SiC MOSFETs revenues in global market, 2018-2023 (Estimated), ($ millions)

- Key companies SiC MOSFETs revenues share in global market, 2023 (%)

- Key companies SiC MOSFETs sales in global market, 2018-2024 (Estimated), (K Units)

- Key companies SiC MOSFETs sales share in global market, 2023 (%)

- STMicroelectronics

- Microsemi

- Wolfspeed

- ROHM

- Littelfuse

- Infineon Technologies

- ON Semiconductor

- Rising Adoption of Electric Vehicles (EVs): The growing shift towards electric vehicles has led to an increased demand for SiC MOSFETs, as they offer higher efficiency and power density compared to traditional silicon-based transistors.

- Renewable Energy Applications: SiC MOSFETs are being increasingly used in renewable energy systems such as solar and wind power inverters due to their ability to operate at higher temperatures and voltages, resulting in improved energy conversion efficiency.

- Industrial and Power Electronics: The industrial sector is also driving the demand for SiC MOSFETs, particularly in applications such as motor drives, power supplies, and UPS (Uninterruptible Power Supply) systems, where high efficiency and reliability are crucial.

- Advancements in Manufacturing Processes: Ongoing advancements in SiC MOSFET manufacturing processes are leading to cost reductions and improved performance, making them more competitive with traditional silicon-based solutions.

- Increasing Investment in SiC Technology: Many semiconductor companies and research institutions are investing in the development of SiC technology, leading to innovations in device design, packaging, and integration, further driving market growth.