Introduction

Electrodeionization (EDI) has emerged as a central technology in the quest for high-purity water across the Middle East and North Africa (MENA) region. With an increasing focus on sustainable water treatment solutions and the rising demand for ultra-pure water in various industries, EDI has gained significant traction. Let's delve into the trending news and developments shaping the EDI landscape in the MENA region. Moreover, the MENA region faces unique challenges regarding water scarcity and quality due to its arid climate and limited freshwater resources. As per the World Bank in 2023, By 2030 the amount of water available per capita in MENA will fall below the absolute water scarcity threshold of 500 cubic meters per person, per year and as the population grows, the problem will become even more acute. As population pressures in the region increase, the demand for water resources rises.

Access sample report (including graphs, charts, and figures): https://univdatos.com/get-a-free-sample-form-php/?product_id=57485

1. Rising Demand for High-Purity Water:

The MENA region, known for its arid climate and water scarcity challenges, is witnessing a surge in demand for high-purity water. Industries such as pharmaceuticals, power generation, semiconductor manufacturing, and food and beverage production require water of exceptional quality. This demand is primarily driven by stringent regulatory requirements, technological advancements, and a growing awareness of the importance of water quality in various processes.

2. Technology Advancements:

EDI technology has evolved rapidly, offering improved efficiency, lower energy consumption, and enhanced performance. Manufacturers in the MENA region is investing in advanced EDI systems that integrate cutting-edge materials, membrane technologies, and automation features. These developments result in higher purity levels, reduced maintenance costs, and increased reliability, making EDI a preferred choice for water purification.

3. Focus on Sustainability:

One of the key trends in the MENA region's water treatment sector is the emphasis on sustainability. EDI aligns perfectly with this trend by minimizing chemical usage, reducing waste generation, and conserving water resources. Companies across various industries are adopting EDI solutions as part of their sustainability initiatives, contributing to environmental conservation efforts in the region.

In Abu Dhabi, Sustainable Water Solutions Holding Company - (SWS Holding) is in charge of collecting and treating wastewater discharged from all residential and commercial customers. In 2009, SWS launched an AED 5.7 billion (USD 1.6 billion) Strategic Tunnel Enhancement Programme (STEP), which includes building 41 km of deep sewer tunnels.

4. Integration of Digitalization and IoT:

The integration of digitalization and Internet of Things (IoT) technologies is revolutionizing EDI systems in the MENA region. Smart monitoring, remote diagnostics, and predictive maintenance capabilities are enhancing the operational efficiency and reliability of EDI plants. Real-time data analytics enable proactive decision-making, optimization of performance, and cost-effective management of water treatment processes.

5. Government Initiatives and Regulations:

Governments in the MENA region are actively promoting water conservation and efficient water management practices. This includes incentivizing industries to adopt advanced water treatment technologies like EDI through subsidies, grants, and regulatory frameworks. Collaborative efforts between government agencies, industry stakeholders, and research institutions are driving innovation and adoption of EDI solutions across sectors.

6. Market Expansion and Investment Opportunities:

The MENA region presents significant market potential for EDI providers and investors. The growing industrialization, urbanization, and infrastructure development projects fuel the demand for high-quality water, creating lucrative opportunities for EDI technology providers. Investments in research and development, strategic partnerships, and market expansion initiatives are driving the growth of the EDI market in the region.

7. Challenges and Opportunities:

Despite the promising outlook, the EDI sector in the MENA region faces challenges such as initial capital costs, technical expertise requirements, and regulatory complexities. However, these challenges also present opportunities for innovation, collaboration, and knowledge exchange. Industry players are exploring novel financing models, capacity-building initiatives, and customized solutions to overcome barriers and unlock the full potential of EDI technology.

Click here to view the Report Description & TOC https://univdatos.com/report/mena-electrodeionization-market/

Conclusion

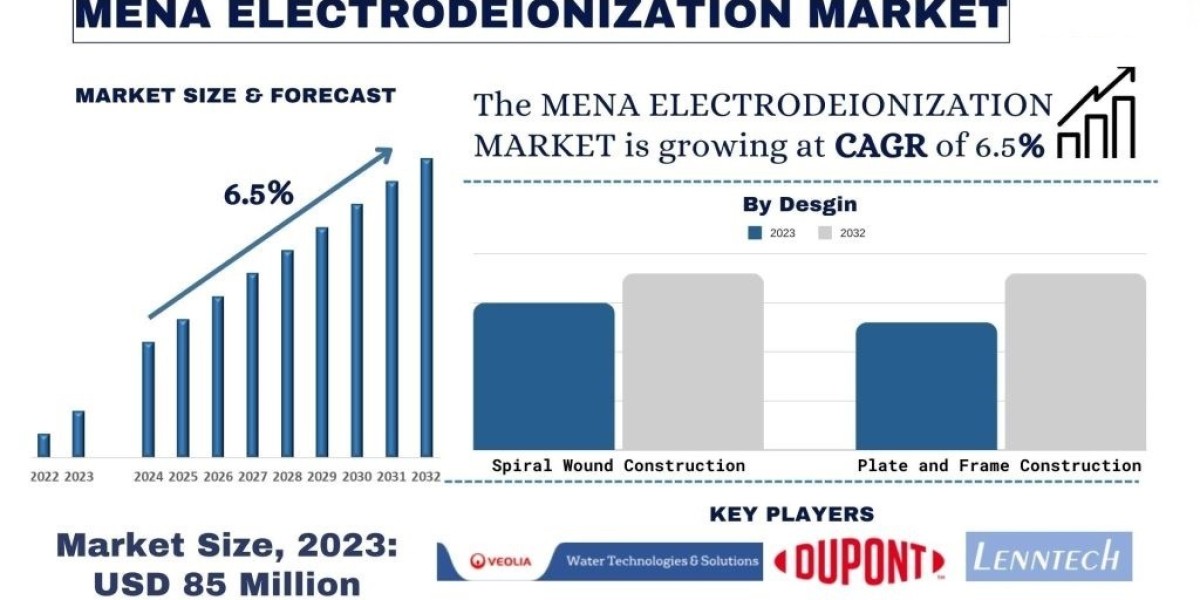

In conclusion, Electrodeionization is at the forefront of transformative changes in the MENA region's water treatment landscape. The convergence of technological advancements, sustainability goals, regulatory support, and market dynamics is propelling the adoption and growth of EDI solutions. As the demand for high-purity water continues to escalate, EDI remains a vital tool for ensuring water quality, resource efficiency, and environmental stewardship across diverse sectors in the MENA region. According to the UnivDatos Market Insights, increasingly focused on sustainable water management practices, increasing need for high-purity water driven by industrial expansion will drive the scenario of the Electrodeionization market, and as per their “MENA Electrodeionization Market” report, the market was valued at USD 85 million in 2023, growing at a CAGR of 6.5% during the forecast period from 2024 - 2032 to reach USD XX billion by 2032.