Global hydraulic workover unit market Statistics: USD 14.1 Billion Value by 2032

Hydraulic Workover Unit Industry

Summary:

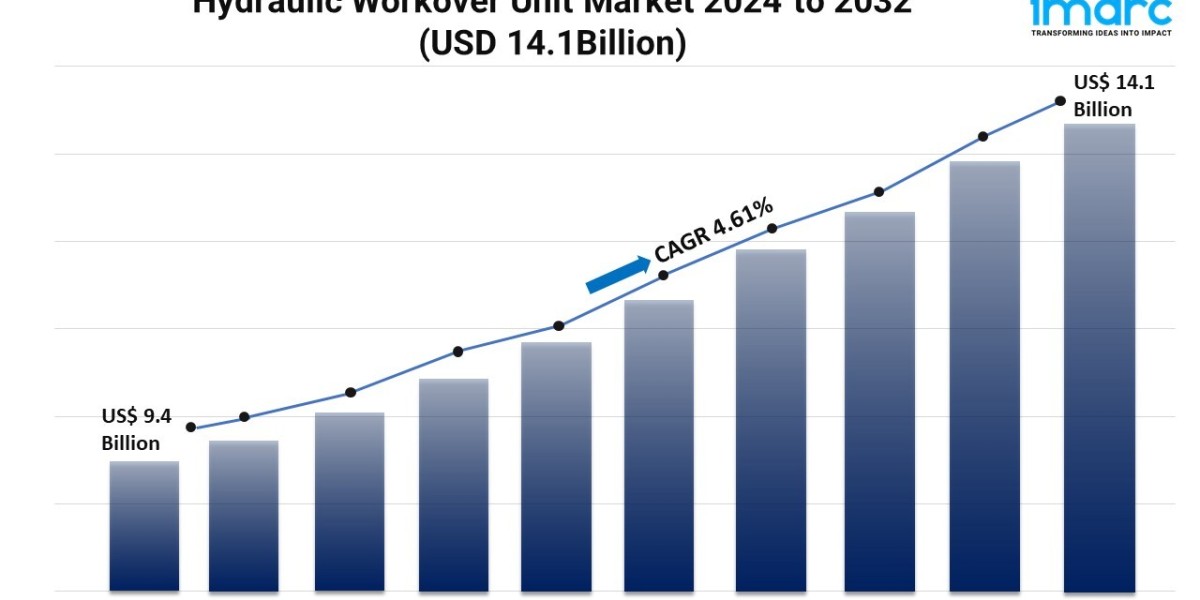

- The global hydraulic workover unit market size reached USD 9.4 Billion in 2023.

- The market is expected to reach USD 14.1 Billion by 2032, exhibiting a growth rate (CAGR) of 4.61% during 2024-2032.

- North America leads the market, accounting for the largest hydraulic workover unit market share.

- Workover accounts for the majority of the market share in the service segment due to the increasing demand for maintenance, production optimization, and intervention in aging wells.

- Trailer mounted holds the largest share in the hydraulic workover unit industry.

- Above 150 tons remain a dominant segment in the market.

- Onshore represents the leading application segment.

- The growing global demand for energy, particularly oil and gas, is a primary driver of the hydraulic workover unit market.

- Technological advancements in hydraulic workover units are reshaping the hydraulic workover unit market.

Industry Trends and Drivers:

- Increasing Offshore Oil and Gas Exploration:

The growing global demand for energy, particularly oil and gas, is driving the need for more advanced exploration techniques, especially in offshore environments. Offshore fields, including deepwater and ultra-deepwater reserves, are becoming key sources of oil and gas production. Hydraulic workover units (HWUs) provide a cost-effective and safe solution for maintaining and enhancing production in these challenging environments. Unlike traditional drilling rigs, HWUs can operate in high-pressure conditions and perform complex interventions, making them ideal for offshore applications. With oil companies increasingly focusing on optimizing production from aging offshore fields, the use of HWUs is expanding. The ability of these units to perform both well intervention and drilling functions in offshore settings makes them highly valuable for maximizing output in areas where traditional methods might be costly or technically difficult.

- Cost-Effectiveness in Well Interventions:

Hydraulic workover units offer a more economical alternative for well intervention compared to conventional drilling rigs. One of the main advantages of HWUs is their ability to perform a wide range of well maintenance tasks, including tubing replacements, plug and abandonment operations, sidetracking, and fishing, without the need for a full-scale rig. This reduces the costs associated with hiring, mobilizing, and operating larger drilling equipment. In mature oil fields, where regular well intervention is required to maintain production levels, HWUs provide an efficient and cost-saving solution. Additionally, they are highly mobile, meaning they can be transported and set up more quickly than traditional rigs, reducing downtime and increasing overall operational efficiency. For operators looking to cut expenses in both offshore and onshore settings, HWUs offer a more flexible and budget-friendly option, contributing to their growing demand across various oil and gas markets.

- Technological Advancements in Well Intervention:

Technological improvements in hydraulic workover units are significantly contributing to their widespread adoption. Modern HWUs are increasingly being integrated with automation technologies, which allow for more precise control of operations, minimizing human error and enhancing safety. Enhanced lifting capacities and improved mechanical systems enable these units to handle more challenging well interventions, including operations in high-pressure and high-temperature wells. Innovations in remote monitoring and control also allow operators to oversee HWU operations in real-time, improving decision-making and response times in critical situations. The incorporation of environment friendly technologies, such as systems that reduce emissions and energy consumption, is also making HWUs more appealing in regions with stringent environmental regulations.

Hydraulic Workover Unit Market Report Segmentation:

Breakup By Service:

- Workover

- Snubbing

Workover exhibits a clear dominance in the market due to the increasing demand for maintenance, production optimization, and intervention in aging wells.

Breakup By Installation:

- Skid Mounted

- Trailer Mounted

Trailer mounted represents the largest segment because of their mobility, ease of transportation, and faster setup times.

Breakup By Capacity:

- 50 Tons

- 51 to 150 Tons

- Above 150 Tons

Above 150 tons hold the biggest market share as heavy-duty operations often require high-capacity units to handle complex interventions.

Breakup By Application:

- Onshore

- Offshore

Onshore accounts for the majority of the market share owing to the majority of well intervention activities being conducted in mature onshore oilfields.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America dominates the market attributed to extensive oil and gas operations, particularly in the United States and Canada, with a focus on both shale and conventional fields.

Top Hydraulic Workover Unit Market Leaders:

The hydraulic workover unit market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

- Basic Energy Services Inc.

- Canadian Energy Equipment Manufacturing FZE

- Cased Hole Well Services LLC

- CUDD Pressure Control Inc. (RPC Inc.)

- EEST Energy Services (Thailand) Limited

- Halliburton Company

- High Arctic Energy Services Inc.

- NOV Inc., PT Elnusa Tbk (PT Pertamina)

- Superior Energy Services Inc.

- Tecon Oil Services Ltd.

- Velesto Energy Berhad

- WellGear Group B.V.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145 | United Kingdom: +44-753-713-2163