The global personal accident and health insurance market has witnessed substantial growth in recent years, driven by increasing awareness of the importance of personal financial security and rising healthcare costs. This market, which includes accident and health policies, covers medical expenses, hospitalization, and accident-related costs, offering financial protection to individuals and families. As the world becomes more health-conscious and risk-aware, this sector is expected to expand further.

Market Overview

The personal accident and health insurance market is a rapidly growing segment of the broader insurance industry. Personal accident insurance provides financial benefits in the event of accidental death, disability, or injury, while health insurance covers medical expenses due to illness or hospitalization. Both are essential in today’s economy, where healthcare costs are escalating, and the risk of unforeseen accidents is always present.

With increasing medical expenses and changing lifestyles, consumers are prioritizing health insurance as a critical element of their financial planning. Simultaneously, personal accident insurance has become more popular due to its ability to cover the financial risks associated with accidents, which can lead to long-term disabilities or death.

Key Growth Drivers

Several factors are driving the expansion of the personal accident and health insurance market:

Rising Healthcare Costs: The increasing cost of medical treatment has made health insurance essential for individuals seeking to safeguard themselves against financial burdens caused by illnesses, surgeries, and hospital stays.

Growing Health Awareness: A surge in awareness regarding the importance of maintaining good health has led to higher demand for comprehensive health insurance policies, especially those covering critical illnesses.

Increased Accidents and Disabilities: With urbanization and growing transportation networks, the rate of accidents has increased, prompting individuals to invest in personal accident insurance to mitigate financial risks in the case of an accident.

Government Initiatives: Many governments around the world have started offering healthcare subsidies or mandating health insurance coverage, which has helped expand the market.

Technological Advancements: The rise of digital insurance platforms, mobile applications, and online claim processing has made it easier for consumers to compare and purchase policies, driving further market growth.

Market Segmentation

The personal accident and health insurance market can be segmented into the following categories:

- By Type of Coverage: Accident-only coverage, accident and health coverage, critical illness coverage.

- By Age Group: Children, adults, and the elderly.

- By Distribution Channel: Direct sales, brokers, bancassurance, and online platforms.

- By Region: North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

Among these, health insurance policies dominate the market due to the increasing demand for coverage related to medical and hospital expenses.

Regional Insights

- North America is one of the largest markets for personal accident and health insurance, driven by high healthcare costs and the strong regulatory framework around mandatory health insurance.

- Europe follows closely, with many countries offering both private and public health insurance options. Aging populations and government healthcare reforms have led to increased demand.

- Asia-Pacific is expected to witness the highest growth rate, with rising disposable income, increased healthcare spending, and improving awareness of health insurance in countries like China, India, and Japan.

- Latin America and the Middle East & Africa are also seeing growth, although at a slower pace, due to economic constraints and low insurance penetration in some regions.

Challenges Facing the Market

Despite its growth, the personal accident and health insurance market faces several challenges:

- Low Insurance Penetration in Developing Countries: In many developing countries, the insurance market is underpenetrated, largely due to a lack of awareness and affordability.

- Regulatory Hurdles: Varying regulatory environments across different regions make it challenging for insurance companies to maintain compliance while offering consistent services.

- Fraudulent Claims: Insurance fraud remains a concern, leading to increased operational costs for insurers and affecting profitability.

Future Outlook

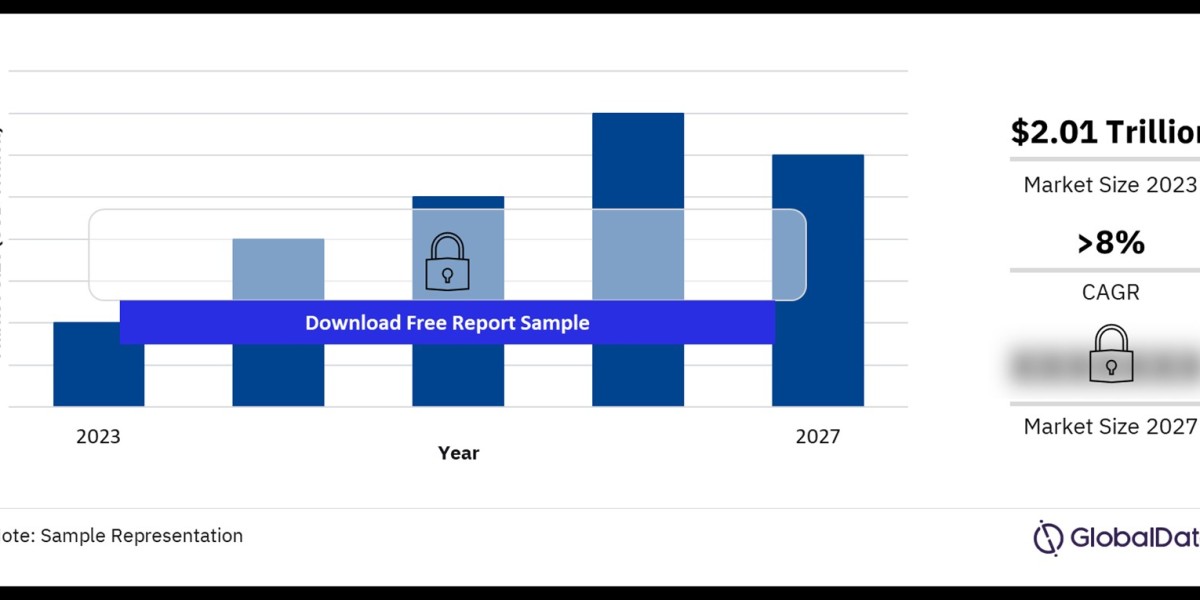

The personal accident and health insurance market is expected to continue growing in the coming years, with advancements in healthcare technology and the introduction of new insurance products catering to evolving customer needs. The rise of digital platforms and mobile applications will further streamline the purchasing and claims process, enhancing customer experiences.

Furthermore, the COVID-19 pandemic has underscored the importance of health insurance, with an increased focus on comprehensive policies that offer coverage for critical illnesses, pandemics, and lifestyle diseases. This shift is likely to lead to more product innovation and expansion in emerging markets.

Buy the Full Report for Additional Insights on the PA&H Market Forecasts, Download a Free Sample Report