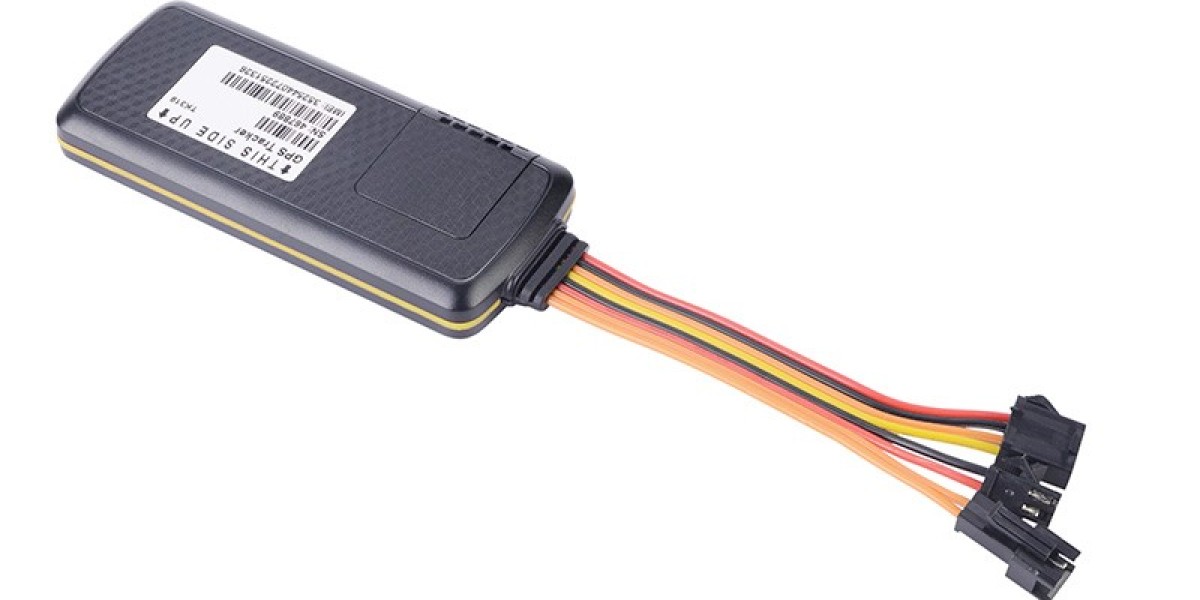

4g wireless tracker is a very important means of risk control in auto mortgage loans, which is widely used by various financial leasing companies or auto finance companies, aiming to do a good job in the last line of defense of post-loan management. With the rapid development of 4g wireless tracker, it can be described as "success and failure" for the post-loan risk management of auto finance.

In the actual operation after the loan, the collection department relies on GPS technology and outsourcing collection team to recover economic losses, is the most direct and effective method! However, there are more and more 4g wireless tracker anomalies in practice, the reason is nothing more than: The debtor or the second mortgagor deliberately shields the GPS signal, or finds professional and technical personnel to directly remove the manufacturer's GPS, or places a shield on the vehicle, and the positioning signal is isolated, or the vehicle is parked in a professional underground garage, resulting in the signal cannot be transmitted back. Now more and more banks, auto finance companies and leasing companies began to install advanced vehicle GPS positioning system, in addition to having a regular return GPS positioning information, remote power off, illegal destruction of GPS warning and other functions, but also add big data information such as electronic fence, mortgage car risk area active warning and other functions, can effectively prevent car owners from cheating or debt evasion. The on-board 4g wireless tracker, through the network service platform, can monitor the vehicle information in real time, query the driving trajectory, and prevent loan scammers from modifying cars and stealing them.

Although GPS technology for car loan risk control is not omnipotent, but no GPS is absolutely impossible! How does GPS operate in the car loan process?

1. After the credit audit manager agrees to the loan, contact the GPS manufacturer and agree on a time to install GPS for the mortgaged vehicle.

2, responsible for the daily monitoring of GPS data, GPS alarm information or any abnormal situation must be reported to the risk control manager immediately. Each vehicle should be monitored at least 5 times a day and the monitoring time should be reasonably allocated. The GPS specialist's mobile phone must be turned on 24 hours a day and the monitoring software turned on to receive possible alarm information.

3. Responsible for the inspection of GPS installation of mortgaged vehicles. Whether the mortgaged vehicle is correctly installed with GPS monitoring equipment according to the requirements of the company, whether the installed GPS equipment works normally and whether the positioning information is accurate.

4. Cooperate with the collection personnel in the collection work, and provide GPS positioning tracking information for the whole collection work.

For normal car loan users, in fact, there is no need to worry, the car GPS will not affect the normal use of the vehicle, but the car loan company plays an insurance role.

4g wireless tracker https://www.eelinktracker.com/4G-GPS-Tracker/