Retirement Calculator

Retirement is a phase many of us look forward to—a time to savor the fruits of our labor and embrace a new chapter in life. But to truly enjoy this period, careful planning is essential. This is where a retirement calculator comes into play. This powerful tool can help you estimate how much you need to save and guide your financial strategy. Let’s dive into the intricacies of retirement calculators and how they can ****ist you in planning for a comfortable retirement.

What Is a Retirement Calculator?

A retirement calculator is a financial tool designed to estimate how much money you'll need to retire comfortably and ****ess whether you're on track to meet your retirement goals. It considers various factors, such as your current savings, expected retirement age, desired retirement income, and life expectancy, to provide a forecast of your financial future.

How Does a Retirement Calculator Work?

At its core, a retirement calculator takes your inputs and runs complex mathematical models to project your financial status at retirement. Here’s a simplified breakdown of how it works:

Input Data: You start by entering essential information, including your current age, planned retirement age, current savings, annual contributions, and expected rate of return on your investments.

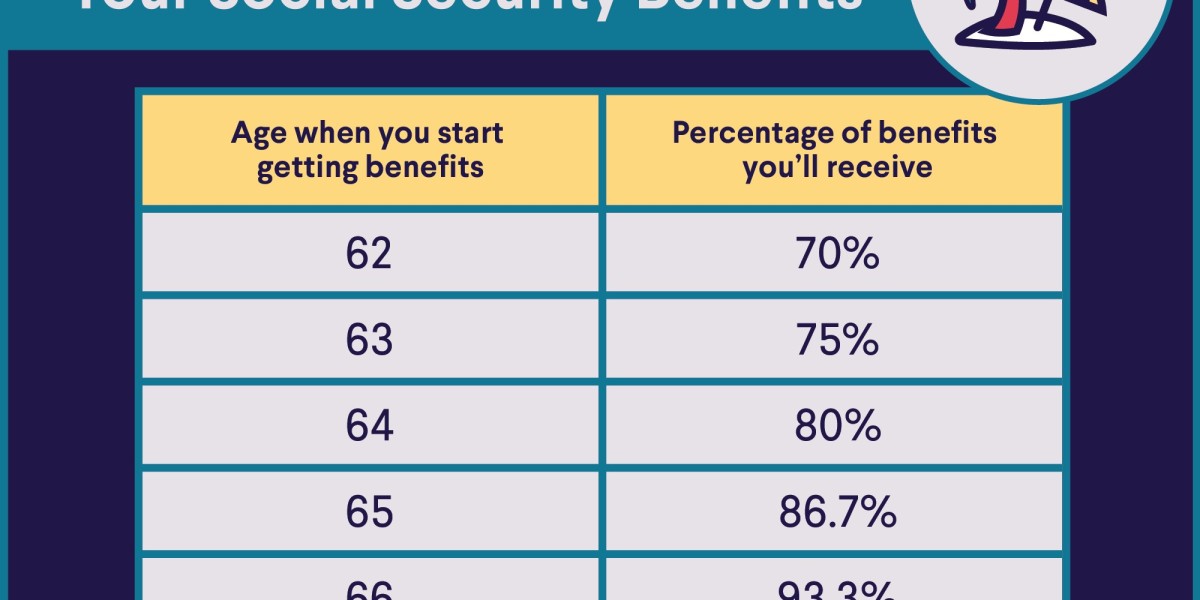

Income Needs: Specify your expected annual retirement income, which can include Social Security benefits, pensions, and any other income sources.

Inflation and Growth Rates: The calculator considers inflation rates and the anti****ted growth rate of your investments. This helps in estimating the future value of your savings and the cost of living in retirement.

Output Projections: Based on the input data, the calculator provides projections of how long your savings will last in retirement and whether you'll have enough to cover your desired lifestyle.

Key Factors to Consider

When using a Weight Loss Calculator, it's crucial to understand the key factors that can impact the accuracy of your projections:

Savings Rate: The amount you save regularly significantly influences your retirement readiness. Even small, consistent contributions can grow substantially over time due to the power of compound interest.

Investment Returns: The rate of return on your investments can vary. A more aggressive investment strategy might offer higher returns but comes with increased risk, while a conservative approach might provide stability but lower growth.

Inflation: Over time, inflation erodes the purchasing power of your money. A realistic estimate of future inflation rates is crucial for ensuring your retirement savings maintain their value.

Longevity: Estimating how long you'll live is challenging, but it's important for planning your retirement funds. People are living longer, which means you need to ensure your savings can last throughout your retirement.

Healthcare Costs: Healthcare expenses tend to rise with age and can be a significant part of retirement planning. Make sure to account for these potential costs in your calculations.

Benefits of Using a Retirement Calculator

Personalized Planning: A retirement calculator offers tailored insights based on your specific financial situation, helping you create a more accurate and effective retirement plan.

Goal Setting: It helps in setting realistic savings goals and milestones, enabling you to track your progress and make necessary adjustments.

Scenario Analysis: Most calculators allow you to test various scenarios, such as changing retirement ages or adjusting savings rates, to see how different factors affect your retirement outcome.

Peace of Mind: By providing a clear picture of your financial future, a retirement calculator can reduce anxiety and help you feel more confident about your retirement plans.

Choosing the Right Retirement Calculator

There are numerous retirement calculators available online, ranging from simple tools provided by financial ins****utions to more sophisticated versions offered by financial planning software. When selecting a calculator, look for one that:

Is User-Friendly: Choose a tool that is easy to navigate and understand.

Offers Detailed Analysis: A good calculator will offer more than just a basic estimate, including insights into how different factors affect your retirement readiness.

Is Up-to-Date: Ensure that the calculator uses current data and ****umptions for accurate projections.

Final Thoughts

CalculatorWeb.Net can be a complex process, but a retirement calculator is a valuable resource in simplifying it. By understanding and utilizing this tool, you can make informed decisions, set realistic goals, and work towards a financially secure and enjoyable retirement. Remember, retirement planning is not a one-time task but an ongoing process. Regularly revisiting your calculations and adjusting your plan as needed will help ensure that you stay on track to achieve the retirement you envision.